Wire harness raw materials will usher in the second wave of price increases

Suspend delivery! DuPont announced that it will be out of stock until June!

The upstream raw materials stop and stop again, and the delivery of downstream finished products can only be delayed again and again.

On April 21, DuPont again issued the "Supplementary Notice of Force Majeure Regarding Crastin PBT Products":

Since INEOS, the main supplier of purified terephthalic acid (PTA), one of the key raw materials required for the manufacture of Crastin PBT polymer, announced force majeure on March 2, 2021, the future cannot be determined so far. supplying time. And North American PTA manufacturers also announced force majeure on April 19, 2021.

DuPont said that from the current point of view, the severe shortage will continue until June 2021.

Prior to this (February 19), DuPont issued an announcement stating that raw material suppliers were out of stock due to force majeure, and announced that from February 22, 2021, Zytel® (including Zytel® HTN and Zytel® special nylon), Crastin ®, Rynite®, Selar®, Minlon®, Pipelon® will be temporarily suspended.

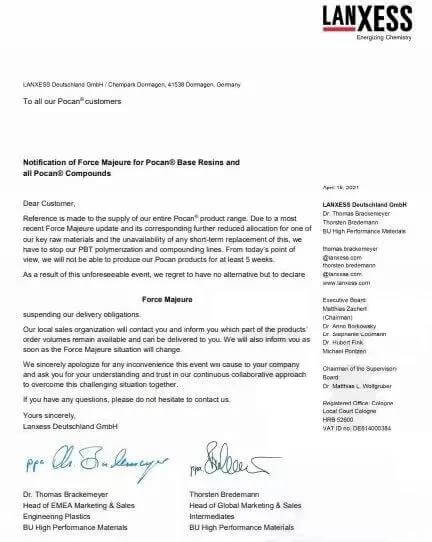

LANXESS also suspended the supply. On April 18, LANXESS issued an announcement: Resins and base compounds are force majeure, to stop the production of PBT polymers and subsidiary production lines, and to suspend delivery.

Effective immediately! BASF issued three notifications in a row to declare force majeure!

The more the price increases, the more the water is reversed? Recently, BASF issued three notices in a row announcing force majeure, and the production series of products will be reduced or suspended, effective immediately.

On April 21, BASF announced that all PA66 products have encountered force majeure, which will take effect immediately and the duration is unpredictable.

On April 19, BASF announced that due to force majeure in the supply of raw materials such as adiponitrile (ADN), HMD, 2PN, and AH salt, the time to resume supply is uncertain. Therefore, BASF announced that it has declared force majeure on the supply of Ultramid® A, Ultramid® AC polymers and other products from the date of the announcement.

On the same day (April 19), BASF announced that due to the shortage of some key raw materials, the European company's PBT force majeure took effect.

From May 1st, many giants such as Dow and BASF will raise prices again!

The price increase will be late, but will not be absent.

▶▶▶Dow: The four giants of silicone collectively increase their prices by 5-20%!

According to industry sources, Dow Silicones, headquartered in the United States, will increase its quotations for silicone products from May, and its distribution agents have begun to notify downstream companies of price adjustments since early April.

Source: DIGITIMES

So far, the world's four major silicone manufacturers-Momentive and Dow in the United States, Wacker in Germany and Shin-Etsu in Japan have all increased their prices by 5%-20%.

▶▶▶Henkel: series of products have increased prices!

On April 20, the adhesive giant Henkel stated that due to the sharp rise in a variety of key raw materials, starting from May 1, the company's series of products will undergo price adjustments.

On April 16, SI Group announced that due to rising freight and raw materials, the price of plastic additives was raised by 20%. The vice president said that the price adjustment also reflects the dynamics of demand for plastic additives.

▶▶▶SABIC: The price of resin products has increased! The highest increase is 16,000 yuan/ton!

According to the SABIC announcement, due to the imbalance between the supply and demand of raw materials, SABIC's resin products will be all adjusted upwards from May 17th! Among them, PC resin has been raised up to 16245.3 yuan/ton.

▶▶▶BASF: Increase by 10%!

Chemical giant BASF announced that the kaolin business is increasing the price of its entire product portfolio by 10%, and the price change is effective for all materials permitted on or after May 1, 2021 or in the contract.

▶▶▶Domestic giants increase prices one after another!

The upstream price increases are transmitted to the middle and lower reaches. At present, the coatings, resin and other industries have set off another wave of price increases!

▶▶▶Nearly 100 chemical companies have stopped production for maintenance, and some products may be affected!

In addition, some chemical plants will be shut down for maintenance in May. At that time, raw materials such as methanol, butadiene, and pure benzene may be affected.

*List of May Maintenance Companies

*List of maintenance companies in the second quarter

Giant pricing may push some products to continue to rise!

Recently, many departments have voiced that domestic bulk commodities will strengthen price regulation. However, we do not have pricing power for products monopolized by foreign giants, so these giants can only passively accept price increases. The upstream supply of some raw materials in the chemical industry has been tight, so price increases may be difficult to end for a while.

The data is the most direct. Among the 64 important chemical products monitored last week, 38 rose varieties, accounting for 59.38%, and more than half of the products rose.

Recently, SABIC issued a letter announcing that due to the imbalance between supply and demand, the price of some products in North America will be raised from May 17th:

LEXAN (PC) resin rose by US$0.75/kg (approximately RMB 4873.6/ton).

CYCOLOY (ABS) resin rose by US$0.75/kg (approximately RMB 4873.6/ton).

VALOX (PBT) flame retardant resin rose 0.75 US dollars / kg (approximately 4873.6 yuan / ton).

XENOY (PC/PET) resin rose by US$0.75/kg (approximately RMB 4873.6/ton).

XYLEX (PC/polyester alloy) resin rose 2.5 US dollars/kg (about 16245.3 yuan/ton).

At the same time, BASF issued three notifications in a row announcing force majeure.

On the 21st, BASF stated that it received a force majeure notice from raw material suppliers on Monday, and that raw materials such as adiponitrile (ADN), hexamethylene diamine (HMD) and AH-salt will be reduced in supply. This directly affected the supply of BASF's PA66 products (Ultramid A and UltramidC, CapronPA66). Therefore, BASF announced that all PA66-based products have encountered force majeure, effective immediately. At this stage, the duration of force majeure is unpredictable.

On the 19th, BASF announced that its European company supplies the recent force majeure statement of some key raw materials, resulting in a shortage of raw materials, and the force majeure of PBT/ULTRADUR polymers and compounds will take effect immediately.

On the 19th, BASF announced that due to force majeure in the supply of raw materials such as adiponitrile (ADN), HMD, 2PN, and AH salt, the time for the restoration of supply is uncertain. Therefore, BASF announced that it has declared force majeure on the supply of UltramidA, UltramidAC polymers and other products from the date of the announcement.

DuPont issued the "Supplementary Notice of Force Majeure Regarding Crastin PBT Products": As one of the key raw materials required for the manufacture of Crastin PBT polymers-INEOS, the main supplier of purified terephthalic acid (PTA), in March 2021 After the force majeure was announced on the 2nd, the future delivery time has not been determined so far. DuPont's German PBT production plant was closed on April 15, 2021, and will remain closed until sufficient raw materials are available. DuPont said that from the current point of view, the severe shortage will continue until June 2021.

Most people are surprised by the increase of 1,6245.3 yuan/ton by large chemical factories caused by the imbalance of supply and demand. It is understood that after the chemical market in the first quarter, the key word of the chemical market in the second quarter has become "tight goods prices." The imbalance between supply and demand mentioned by SABIC is also common in the domestic market. Whether it is voluntary parking inspections and repairs by companies, forced "relocations and transfers", or the recent tightening of environmental inspections and local inspections, they will all be affected. The chemical industry, with tight supply and short supply, has taken another step toward the "deep".

Nearly one hundred chemical companies stopped for maintenance, the longest period was 95 days. Environmental inspections and local inspections have become stricter, and some companies have suspended production restrictions

Recently, 8 central ecological and environmental protection inspection teams have carried out inspections for about one month in 8 provinces (regions), namely Shanxi, Liaoning, Anhui, Jiangxi, Henan, Hunan, Guangxi, and Yunnan. Although the document emphasizes that the relevant provinces (regions) strictly prohibit simple and rude actions such as emergency shutdowns and production shutdowns in response to inspectors, as well as perfunctory responses such as "all shutdowns" and "stop first, then speak", but in fact, some areas still adopt more "radical" actions. "The way to stop production.

It is reported that the Fourth Central Ecological and Environmental Protection Inspection Team entered Jiangxi on April 7 for a period of one month. Local companies said that affected by this, the scope of rare earth reduction and shutdown companies has expanded again, and it has spread to raw ore separation plants. Previously, most of them were waste separation plants. At present, some plants are ready to stop.

In some places, under the name of "emergency response", shutdowns were implemented according to regions and industries. In addition, some areas have publicly notified in the chemical group that some chemical companies and industrial manufacturing companies will stop production, or even stop production for about one month.